Even long-term financial success won’t come from a single path. If you want to maximize your returns and minimize your risks, utilizing a risk management strategy combined with diversification could be your key to success. This article will explore how to maintain the balance of risk and returns with these two strategies.

1. Embrace the Risk Factor: How Risk Management & Diversification Bring Balance to Your Portfolio

Invest in Different Assets

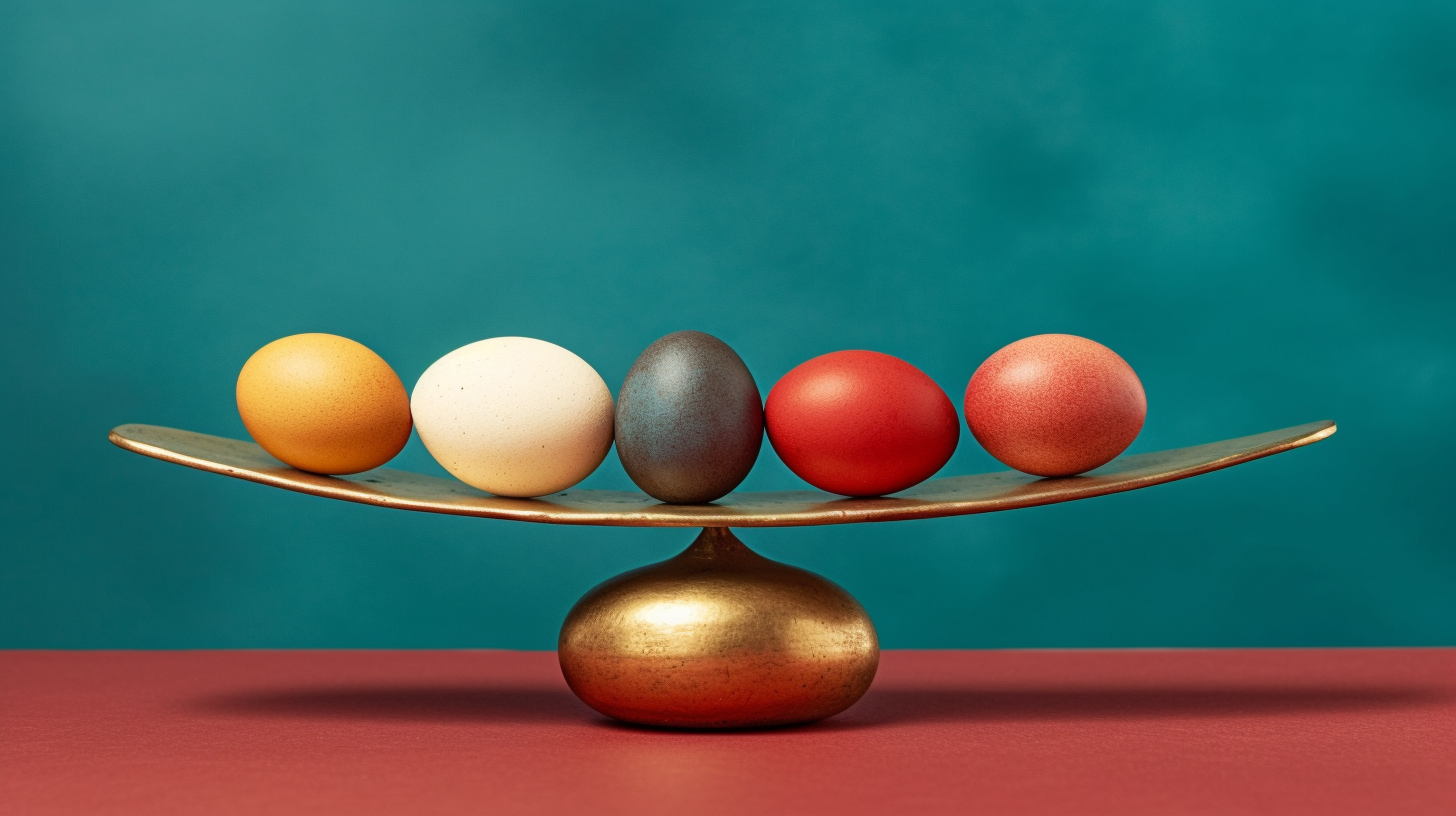

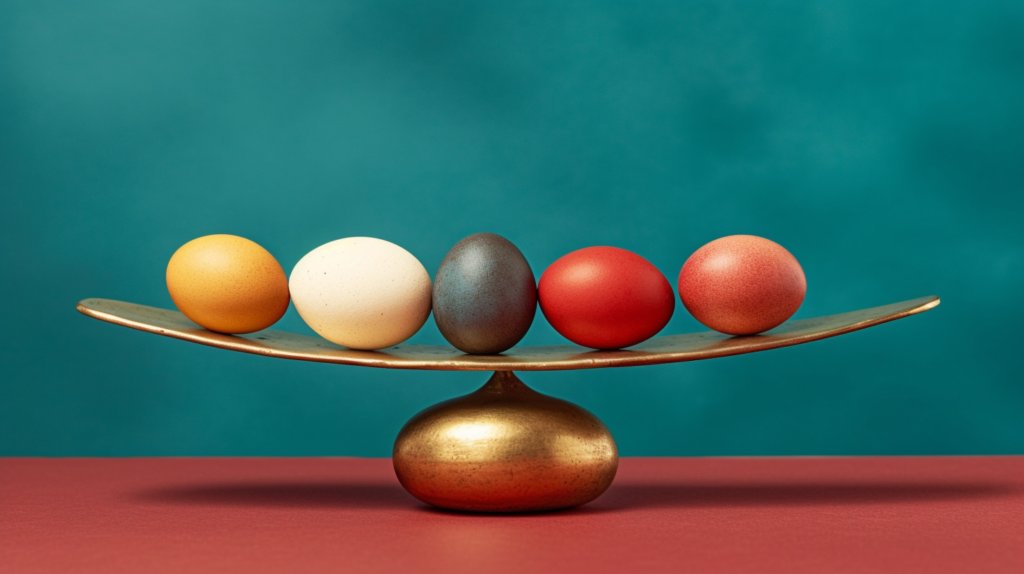

Investing is all about diversification, that means spreading your risk across different assets. Don’t leave all your eggs in one basket! Investing in different asset classes allows for a balanced portfolio and will ensure you keep your risk to a minimum. Invest in stocks, bonds, ETFs, and other investments products to keep your portfolio well diversified.

Choose the Right Risk Level

To make sure your portfolio has a good risk/return balance, it’s important to evaluate the risk you are comfortable with. Consider the type of investments you want to make: those with a higher short-term return will carry a higher risk. Determining a suitable return for your investment in line with your individual capacity for risk will ensure your portfolio is managed in an optimal way.

Make an Active Management Strategy

Once your portfolio has been diversified with different asset classes and a suitable risk level, it’s time to make an action plan. Make regular check-ins on your portfolio performance and readjust your funds as needed. Keep an eye on market movements and make proactive decisions to ensure your investments are in line with your goals. A good risk management strategy should be active and evolving in order to stay on top of changing market conditions and investment opportunities.

2. Understanding Risk: A Necessary Step to Successful Risk Management & Diversification Strategies

Mapping out the risks you face in your investments requires an understanding of the different types of risks you could be exposed to. Without a firm grasp of these different risks, no risk management strategy is complete.

Types of Investment Risks

Investment risks fall into two broad categories:

- Market Risk: Changes in the overall market can lead to changes in the value of your investments.

- Inflation Risk: When inflation is higher than expected, the future value of your investments may be lower.

- Credit Risk: When the issuer of a bond defaults, you may lose the value of your investment

- Interest Rate Risk: When interest rates change, the prices of bonds and other investments can change significantly.

A solid understanding of these different forms of risk will give you a better understanding of where you’re exposed. You can use this knowledge to create diversification strategies to spread out your risk and maximize returns.

Through diversification, you can reduce the amount of risk you take on and increase the chances of success in the long-term.

3. Balance Through Diversification: Revisit Your Investment Options

When it comes to investing, diversification should be your ultimate goal. It pays to explore multiple options and strategies to ensure you never put all your eggs in one basket. It sounds simpler than it is, so let’s look at some ways to achieve better balance through diversification.

- Spread out your investment choices — Tap into a widw range of industries and assets, whether it’s stocks, bonds, mutual funds, or real estate. Try to achieve a good mix that complements each other.

- Analyze the risks — Assess the associated risks of each choice, and adjust the level of risk to what your current financial situation can accommodate.

An effective diversification strategy will depend on your financial goals. Explore different asset classes and portfolios, and factor in all the variables and opportunities. Consider risk vs reward so that you can devise a diversified portfolio that brings you both security and returns.

4. Leveraging the Power of Risk Management: How to “Cushion” Your Investments

When it comes to investments, risk can be a major differentiator between success and failure. But that doesn’t mean it has to be a total guessing game – risk management is an important tool that can be used to minimize losses. Here are some tips that will help you cushion your investments against the worst-case scenarios:

- Establish clear guidelines: Set out a set of rules and strategies that you’ll use to manage the risk of your investments.

- Analyze the data: Carefully review all of your data on a regular basis. Make sure to keep an eye out for any early warning signs that something might be wrong.

- Have a “Plan B”: Have contingency plans in place to minimize the impact of losses if something does go wrong.

You can also take preventative measures to reduce the risk of losses in the first place. For example, diversifying your investments by investing in lower-risk stocks and investments can help to reduce the chances of suffering substantial losses when the markets take a downturn. As with anything, the key is to be prepared for any eventuality and have a plan in place.

5. Make Friends with Risk: What You Need to Know About Return on Investment

Return on Investment (ROI) is one of the most important metrics in financial planning. Not only does it allow investors to make informed decisions about the investments they make, but it also helps them gauge the amount of risk associated with different investments.

When it comes to making friends with risk, understanding ROI can make all the difference. Here are the key pieces of information you need to know about it:

- ROI is calculated by subtracting the cost of the investment from the total return received, divided by the investment cost.

- The higher the ROI, the higher the return on the investment. This is why investors will often take on more risk in search of higher returns.

- ROI can also be used to compare investment options, as it provides a good way to measure relative performance.

The key is to ensure that you have a good understanding of the concept of ROI and that you are taking the appropriate amount of risk relative to your investment goals. By understanding ROI, you can make smarter investment decisions, and potentially generate higher returns with less risk.

6. Don’t Worry, Be Smart: Knowing When & How to Take Risks

Life without risk can be like a dull game of checkers – there’s very little thrill or excitement to it. On the contrary, life with risk can be an exhilarating rollercoaster of emotions. The key to success is knowing when and how to take risks.

When it comes to taking risks, it pays to be smart. Research is essential, and understanding the potential risks and rewards of a particular endeavor is important. Consider your goals and objectives, and make sure the decision is aligned towards them. Don’t be influenced by unfounded optimism, and stay focused on the facts.

While taking risks is essential for progress, it’s important to take calculated risks. One of the most effective ways to minimize the risk is to weigh the impact on your life in terms of personal gain, time and effort. You’ll also need support to help you cope in unpredictable or unforeseen conditions. :

- Always be prepared. Be fully aware of the existential risk of your decision and plan ahead for any consequences.

- Choose risk over certainty. Bear in mind that it’s better to take the risk of failure rather than miss an opportunity for great success.

- Find support. Surround yourself with people who will support and challenge you through your choices.

- Strive for balance. Manage the risk in a way that is balanced with your goals, values and resources.

Ultimately, risk-taking requires informed decision-making, and the confidence to act on those decisions. If done wisely, taking risks can lead to important progress in any aspect of life.

7. Lightening Up with Financial Portfolio Balance: Re-Aligning Assets For Maximum Profitability

Knowing when and how to re-align assets can prove difficult, but it can also lead to major improvements in portfolio profitability. It’s all about understanding the environment in which those assets are situated and subsequently finding the perfect balance. Here are a few tips to help get you started:

- Do Some Research: Evidence shows that those who know what they want from their investment portfolio…and also understand the factors that could influence it over time, are more likely to achieve success. Make sure you investigate sectors and stocks and envisage the strength of their performance under varying market conditions.

- Diversify: Diversification is essential when looking to achieve maximum profitability from a financial portfolio. Don’t rely on just one or a few asset types; consider bonds, mutual funds, commodities, and precious metals & stones to fold into your strategy and share the risk.

- Stay Balanced: Once you have done your research and implemented a diversified asset selection, remain cautious. Monitor the performance of your portfolio and adjust to balance out the strengths and weaknesses of assets as markets shift. This will help you to anticipate and prepare for any bumps you might hit, and sail over them much more smoothly.

The key to lightening up a financial portfolio with maximum profitability is to stay informed, make well-informed decisions, and stay flexible with your assets. As markets fluctuate, the best investors remain poised and ready to pounce on any opportunity and always remain cost-effective and mindful with their portfolios.

8. Reaching Your Financial Goals With Balance: Taking Control of Your Investment Planning

Investing can be intimidating and overwhelming, but it doesn’t need to be. When you take the necessary steps, you can create a plan that puts you in control of your financial future. As you make headway towards your financial goals, here are eight things to keep in mind.

- Balance Knowledge and Professional Advice: You don’t need to be a financial whiz to make smart decisions, but having a fundamental understanding of how the stock market works can help you develop an effective plan. Additionally, investing with a Certified Financial Planner will give you access to the knowledge and insight of an experienced professional.

- Set Financial Goals: Having specific financial objectives gives you something to work towards and hold yourself accountable. Create measurable objectives that read a manageable timeline, like increasing your net worth by 30% within the next five years.

- Start Slow and Steady: The stock market is a volatile beast, and you don’t want to dive in head-first without knowing what you’re doing. Test the waters with a small initial investment and take the time to learn as you go.

As you become more comfortable with a specific investment approach, slowly start to add more money to your portfolio. Set a strict risk tolerance, so you don’t overexpose yourself to the market. Relying on a finance professional can help you navigate the complexities, weigh risks, and manage your investments.

Creating a prudent financial plan is a long-term effort that requires attentiveness and discipline. When you balance knowledge with professional advice, develop a plan that fits your goals, and commit to investing slowly but steadily, you’re well on your way to taking control of your financial future.

Managing risk and diversifying investments are important components of a successful financial strategy. While no one can accurately predict the future, the careful application of sound principles of diversification and risk management might just be the answer to creating financial balance and stability for the long term. Here’s to the power of taking calculated risks!